is a car an asset for medicaid

Today I want to talk about cars trucks and other personal use vehicles. Personal property is almost always an excluded asset so another way of spending down countable savings is by purchasing new personal items such as electronics and clothing.

A Medicaid client owning an automobile may have the vehicle exempt from being counted as an asset subject to the 2000 limitation on the total value of assets if.

. Exempt assets will not be counted when determining your Medicaid eligibility. This could even be a Lamborghini. Because Medicaid is a needs-based program you must pass the income and asset eligibility requirements.

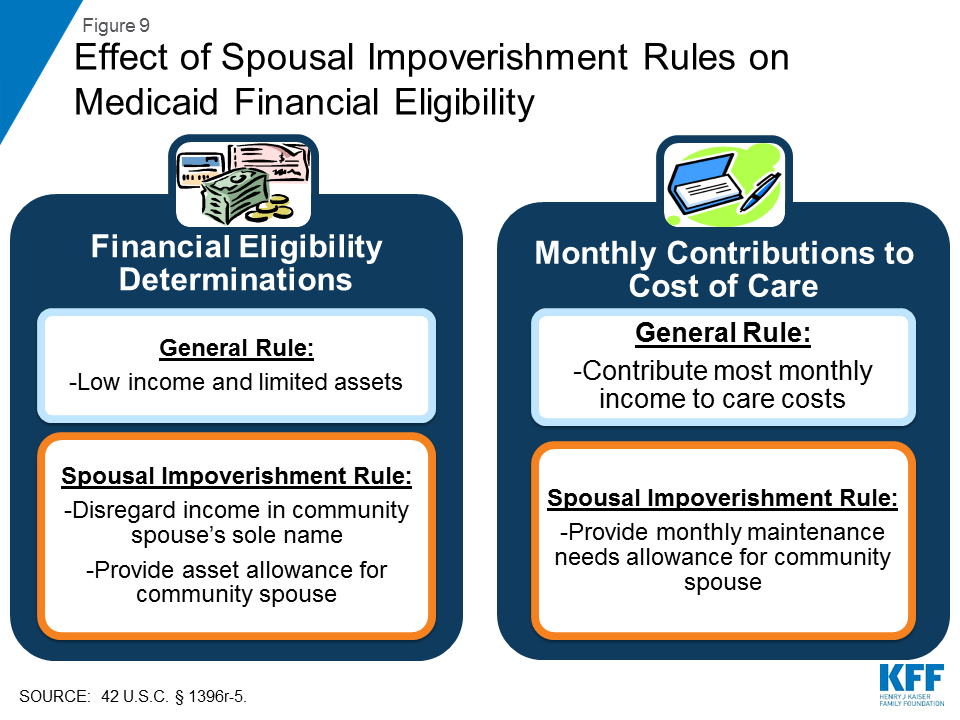

Other exemptions include IRA or 401k payouts burial expenses life insurance policies joint bank accounts and other assets owned by both spouses. To receive Medicaid for long term care a recipient must have less than a certain amount of income and assets. Medicaid also takes your vehicle into account as an asset and limits each Medicaid recipient to one non-countable vehicle in order to qualify.

According to the Florida ESS Policy Manual Section 16400583 and Section 16400591 explain that a single automobile car truck motorcycle etc is excluded as an asset regardless of its value. For example if an individual owns an older car they could spend down assets by purchasing a new car. Generally Medicaid considers the value of any non-refundable pre-paid funeral plan or burial contract exempt.

Even so I think even Medicaid recipients are allowed to own one car. Have a paper trail to prove sister pays the lease. The state sets the income and resource limit each year.

Your Medicaid coverage will be stopped because it shows you can pay for your healthcare cost yourself and you can be charged for fraud. What you can and cant keep with Medicaid. And if the transaction is for fair market value and a fair interest rate there should be no transfer-of-asset issue if it is taken out within the five years before applying for Medicaid.

Can I own a car and qualify for Medicaid. And its not even owned. Hello Im Wes Coulson and this is your Elder Law Minute.

You can own an automobile and qualify for Medicaid. Is a car an asset for medicaid Saturday February 26 2022 Edit Asset Protection And Unforeseen Costs To Prepare For John Ross Asset Protection Car Insurance Judgement C Umbrella Insurance Nursing Home Care Insurance. The short answer is that the mortgage is an asset and its value is the amount left to be paid on it not the original amount of the loan.

This vehicle is excluded from the list of assets and is not regarded as a countable asset according to Medicaid rulings so this is one way to spend down. One automobile of any current market value is considered a non-countable asset for Medicaid purposes as long as it is used for the transportation of the applicant or another member of their household. If you own a car you can rest assured Medicaid is not going to hold it against you no matter how much it costs.

This is another in our series of discussion on what assets you are allowed to keep consistent with Medicaid Eligibility. The home of any value including the land on which it sits and adjoining property. This means you can own one Bentley worth over 100000 and that vehicle would.

To your question some assets are non-countable including the applicants principal place of residence and a car. I am not sure but a leased car is not an asset and cannot be sold so Medicaid should not care as long as his money is not being used to pay for it. An asset includes cash certain life insurance policies bonds stocks money market accounts second homes second cars and anything else that could be potentially converted to cash.

Funeral and Burial Funds. This could even be a Lamborghini. For 2021 New York automatically excludes applicants with assets above 15900 for an individual and 23400 for a family.

In New York assets that are guaranteed to be exempt from Medicaid recovery include household property personal property and vehicles. You have to be familiar with Medicaid in your state to know when not to buy a car while on Medicaid. If you violate the rules of Medicaid your car will be counted as a countable asset.

Exempt assets are not considered when attempting to qualify for Medicaid. However a Medicaid caseworker may consider an extravagant purchase an exotic or luxury car to be a investment and therefore a countable asset. Your home car and personal property may be exempt.

A The answer is probably yes but it depends on the circumstances. Other vehicles are generally considered extra unless they are very damaged or undriveable. However the transfer of a non-countable asset for less than fair market value will result in the imposition of a penalty period which is the amount of time that the Medicaid applicant will be ineligible for Medicaid benefits Whitenack said.

Medicaid Long Term Care Rules. The definition of an exempt asset varies by state. This is where it can be beneficial to take advantage of assets that are excluded.

Can my mother gift her car to my daughter without worrying about the five-year look-back period if she applies for Medicaid. The state will increase Medicaids asset limit from 2000 for an individual to 130000 and from 3000 for a couple to 195000. However the reality could be more complicated and.

You can also exempt a second vehicle older than seven years old unless it is a luxury vehicle or it is an antique or classic car older than 25 years old.

Your Guide To Medicaid Countable Assets The Law Office Of Paul Black

California Is The First State To Move Toward Removing The Asset Limit For Medicaid Eligibility The Weeks Law Firm

2020 Oh Medicaid Guide Income Limits Exempt Assets Long Term Care

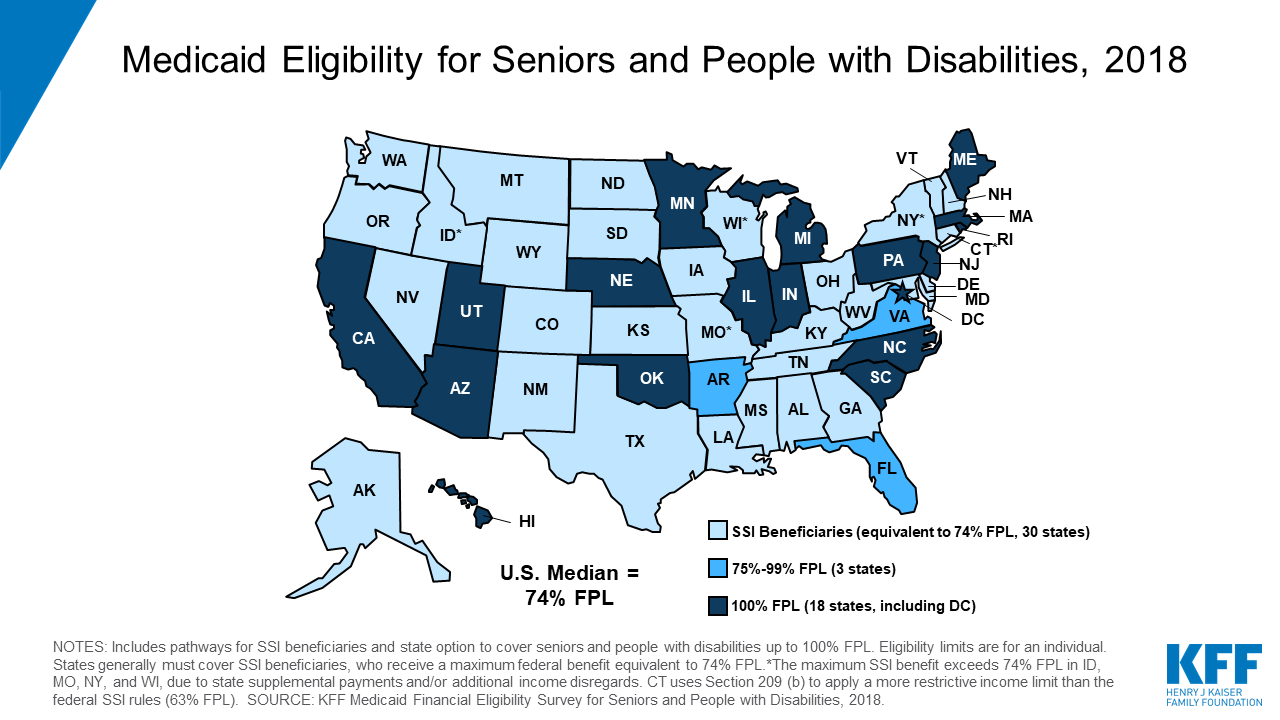

Medicaid Financial Eligibility For Seniors And People With Disabilities Findings From A 50 State Survey Issue Brief 9318 Kff

Medicaid Asset Test And Income Test In Florida

10th Anniversary Edition Of Best Selling Medicaid Planning Book Published Send2press Newswire How To Protect Yourself Medicaid Book Publishing

How Much Money Can You Have And Still Qualify For Medicaid

10th Anniversary Edition Of Best Selling Medicaid Planning Book Published Send2press Newswire How To Protect Yourself Medicaid Book Publishing

How To Qualify For Medicaid In Texas Regardless Of Income Holman Law

How To Use A Life Insurance Policy To Pay For Long Term Care Long Term Care Insurance Supplemental Health Insurance Life Insurance Policy

What Are Medicaid Exempt Assets In Pa

How Do Assets Affect Medicaid Eligibility Richert Quarles

5 Ways To Protect Your Money From Medicaid Elder Care Direction

Medicaid Financial Eligibility For Seniors And People With Disabilities Findings From A 50 State Survey Issue Brief 9318 Kff

California Removing Asset Test For Medicaid Eligibility